World’s newest multilateral development bank lagging on accountability

26 September 2023, Sharm el Sheikh, Egypt: As the Asian Infrastructure Investment Bank (AIIB) meets today for its first in-person annual meeting in four years, civil society groups are questioning the bank’s track record on accountability. In seven years, with 233 projects funded and over $44 billion spent, the AIIB has yet to accept a single complaint from people adversely affected by its investments.

The AIIB, the world’s newest multilateral development bank, established an accountability mechanism, known as the Project-affected People’s Mechanism (PPM), in 2019 to provide recourse to communities affected by projects and to learn from the mistakes made in previous projects. The AIIB will announce a long-awaited review of its PPM at its Annual Meetings in Egypt 25-26 September 2023.*

However, a new report, Roadblocks to Accountability, released today by Recourse, Inclusive Development International and Accountability Counsel, endorsed by groups from around the world1, shows that the AIIB is lagging behind its peers on nine key indicators and exposes the reasons why the PPM has not accepted a single complaint to date. The report looked both at the AIIB’s current portfolio and also at policies guiding the scope and implementation of the PPM. It found that, of projects funded by the AIIB:

- Nearly half of projects are ineligible. Of 219 projects funded by end June 2023, 46% (101 projects) are not eligible for consideration by the PPM, meaning that communities adversely affected by those projects cannot hold AIIB accountable.2

- The main reason for ineligibility is investments being co-financed with other multilateral development banks. Under AIIB’s rules, this excludes them from accountability under the PPM, with some exceptions. The AIIB is an outlier among multilateral development banks on this exclusion – it is the only one to exclude co-financed projects from accountability to its mechanism.

- The largest proportion of eligible projects are supported through financial intermediaries (FIs). Of eligible projects funded since October 2021, when the bank’s new Environmental and Social Framework came into force, the largest proportion – 56% – are FI investments. These are difficult to trace as there is extremely limited transparency about where money ends up. If communities don’t know that the AIIB is investing in the project affecting them, then their access to remedy is effectively blocked.

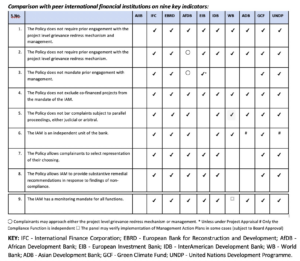

The report also compares the AIIB to its peers among multilateral development banks on nine fundamental indicators of good policy (see diagram below). The AIIB lags behind on every indicator.

Report author Kate Geary, Co-Director of Recourse, said, “The AIIB clearly has an accountability deficit when its accountability mechanism does not apply to nearly half of its portfolio and it has accepted no complaints. This blocks communities affected by the AIIB’s investments from ensuring the AIIB is living up to its environmental and social commitments. We call on the AIIB to close accountability loopholes when it reviews the PPM.”

Lawyer and report author Radhika Goyal of Accountability Counsel said, “The AIIB’s decision to establish its Project-affected People’s Mechanism so soon after it started operations was significant, but unfortunately the PPM Policy that followed and the mechanism’s record in the past five years has failed to meet its mark. When compared to international good practice prevalent at peer financial institutions, AIIB’s PPM Policy falls short on the key indicators of accessibility and remedy. We believe the upcoming PPM Policy Review is a chance for AIIB to get it right this time and we will be advocating for a consultative, transparent, and independent review.”

The report features three case studies – an infrastructure investment trust project In India, a gas-fired power plant in Bangladesh and a metro project in India – which illustrate what the report calls ‘roadblocks to accountability’. These include an ill-defined requirement to engage with AIIB management in ‘good faith’ before filing a complaint. Despite four years of requests to the AIIB to address their concerns about the Bhola gas plant, communities in Bangladesh saw their complaint rejected for what the PPM deemed lack of ‘good faith’ efforts.

Hasan Mehedi of Coastal Livelihood and Environmental Action Network, Bangladesh said, “AIIB throws up roadblocks to accountability so that communities in Bangladesh harmed by its projects cannot get justice. Only radical change at the PPM will show communities that the AIIB is sincere about being an accountable and responsible bank.”

Annabel Perreras of NGO Forum on ADB said, “AIIB can no longer hide behind the excuse that it is a young bank thus it should be held to a different standard. Excluding co-financed projects from the PPM’s mandate essentially deprives communities of their options in filing a complaint. The AIIB should not miss the upcoming review of the PPM as an opportunity to fundamentally address these barriers in enabling communities to have meaningful access to remedy and justice.”

Natalie Bugalski, Legal Director at Inclusive Development International said, “Independent accountability mechanisms can be a lifeline for communities who are harmed by development projects, but only if those communities can actually access the mechanisms. The AIIB must ensure that the PPM is fully accessible to anyone at risk of harm from projects that it finances, both directly and through intermediaries.”

FOR FURTHER INFORMATION PLEASE CONTACT:

Kate Geary, Recourse: kate@re-course.org, +44 7393 189175

Radhika Goyal, Accountability Counsel: radhika@accountablitycounsel.org, +91 97697 34667

Natalie Bugalski, Inclusive Development International: natalie@inclusivedevelopment.net, +1 917 2802430

*The AIIB PPM is a mechanism to receive submissions from project-affected people who believe they have been or are likely to be adversely affected by AIIB’s failure to implement its environmental and social standards (known as the ESP.)

1. Groups endorsing the report include NGO Forum on ADB, CLEAN Bangladesh, Centre for Financial Accountability India, Growthwatch India, Reality of Aid – Asia Pacific, Jubilee Australia, BRICS Feminist Watch, Sustentarse Chile, Latinoamérica Sustentable and Gender Action.

2. From the AIIB’s creation in 2016 to end September 2021, 72 projects out of 142 were ineligible for the PPM according to the report The Accountability Deficit. In the latest report, Roadblocks to Accountability, 29 projects out of a total of 77 (in the period October 2021 to end June 2023) are ineligible for the PPM.