Independent Accountability Offices Prove Their Worth During A Crisis. What About Institutions That Don’t Have Them?

Investors of all kinds – from international financial institutions (IFIs) like the World Bank Group (WBG) and regional development banks to private impact investors – are providing unprecedented levels of financing in response to COVID-19. Given the sheer scope and impact of the crisis, it is vital that this monetary response reaches those who need it most; each dollar misused means less resiliency. The most effective way to understand whether these funds are meeting their mark is by hearing from the very people affected by funded projects. Unfortunately, not all financial institutions and investors responding to the COVID-19 crisis are equipped with the tools needed to receive community feedback and address problems when they arise. This accountability gap risks undermining the effectiveness of the COVID-19 response. In contrast, IFIs have long-had such a system – known as independent accountability offices – that is proving its worth during the crisis and providing a model for how other financiers, including impact investors, can improve the net impact of their response.

The Work Of Independent Accountability Offices Has Always Been Essential

Female workers in Liberia gathered to learn about an accountability office

investigation into Buchanan Renewables’ biomass project

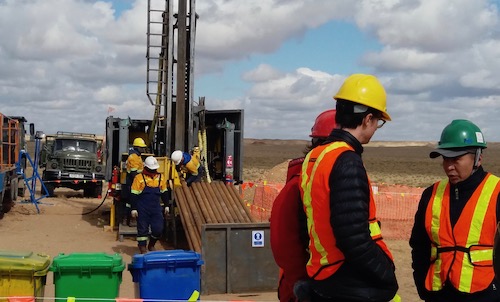

If a project is causing unintended harm, the communities living and working near and at the project sites are the first to know. When IFIs are involved, their accountability offices offer communities a critical channel to raise a variety of grievances – related to, for example, unfair labor conditions, extreme noise pollution, or water contamination – and can facilitate meaningful solutions for both communities and investors. For instance, the independent accountability office for the private sector arm of the WBG, the Compliance Advisor Ombudsman (CAO), facilitated a dispute resolution process in Mongolia that brought together nomadic herders, the Mongolian government, and the mining company Rio Tinto to address community grievances related to a massive copper and gold mine that disrupted the herders’ traditional way of life and livelihoods. Because of the process, the parties were able to reach sweeping agreements that include compensation for displacement and increased access to water. After the agreements were signed in 2017, Battsengel Lkhamdoorov, one of the herders, highlighted the value of the dispute resolution process: “We will continue to be vigilant and make sure what has been agreed to is actually accomplished, but today we feel that our complaints about the negative impact of this mine on local herders are starting to be addressed in a serious way.”

The importance of community feedback and accountability is true for projects with explicit impact goals, including crisis response. We have seen examples of well-intended projects causing unanticipated harm that only became fully known to investors because communities used accountability offices to voice their grievances. Take, for example, a biomass project in Liberia that was billed as an impact investment advancing renewable energy in a country rebuilding after years of devastating conflict. In reality, the project caused deforestation, embedded dependence on charcoal, sent family farmers into poverty, and contaminated water resources, amid sexual abuse and labor rights violations. Similarly, a hydroelectric project in Mexico that was intended to produce renewable energy instead began through illegal land acquisition and endangered local villages’ water supply and the safety of an adjacent dam curtain. When investors learned of these impacts due to communities’ use of an accountability office, they ultimately decided that the project was untenable. In both cases, investors believed that they were benefiting their host communities. Yet it took hearing from those communities through IFI accountability office processes to understand the catastrophic financial, human, and environmental outcomes.

The Work of Independent Accountability Offices Is All the More Critical Amid a Crisis

While there is always a need for community feedback on investment impacts, the fast-paced nature of much of the COVID-19 response makes forums like independent accountability offices all the more critical. This is the case for many IFIs that are fast-tracking financing decisions to respond to the COVID-19 crisis. While this expedited process responds to the urgency of the moment, quick decisions can create risks to project-affected communities and undermine the net impact of investments. Already, there are concerns over a lack of transparency about selected IFI projects. Further, requirements to conduct stakeholder consultations – which are essential to understanding unintended project impacts – are more difficult to meet amid restrictions on travel and in-person gatherings. Because independent accountability offices serve as lifelines for project-affected communities to reach investment decision makers, many independent accountability offices are innovating to meet the moment.

First and foremost, project-affected communities need to know that independent accountability offices exist and are open for business during the crisis. Many independent accountability offices have posted updates on their respective websites that explain how they are conducting their essential work during this time, including the CAO, the Inter-American Development Bank’s (IDB) Independent Consultation and Investigation Mechanism (MICI), and the African Development Bank’s Independent Review Mechanism.

However, website updates are not enough to ensure that communities know that accountability offices are available; active and direct outreach is needed. Independent accountability offices are recognizing that they cannot simply rely on their typical community engagement practices amid restrictions on in-person meetings and travel. The WBG’s accountability office for public sector projects, the Inspection Panel, has started a series of online outreach seminars to educate members of the public on what the Panel is and how it works; a practice all the more necessary given its recent structural reforms. Representatives from the CAO, Panel, and MICI all participated in a recent webinar hosted by the United Nations Human Rights Office of the High Commissioner to introduce people in Latin America to independent accountability offices; approximately 300 participants registered for the first session.

Further, MICI is developing a guide for how to communicate remotely with communities impacted by IDB projects. MICI has consulted with communities and their advocates, including Accountability Counsel, on how to conduct remote conference calls with community members. We are collaborating with MICI to test these remote communication tools in Haiti – where access to strong communications technology is particularly challenging – with the hope that lessons learned from this experience can apply to other cases.

Finally, many who raise objections to development projects are subject to heightened security risks. This is especially the case amid the COVID-19 crisis. With restrictions on movement and increased surveillance, reports show increased risks to human rights defenders. Several accountability offices, including the Inspection Panel and the Asian Development Bank’s Accountability Mechanism, have protocols to address threats of reprisals. The Independent Accountability Mechanism network of 20 accountability offices has also endorsed a toolkit on reprisals that addresses various parts of the complaint process. Accountability offices should ensure that these protocols are fully implemented and should explore new tools or adjustments in the protocols to address some of the particular challenges posed by the pandemic.

Financial Flows Without Independent Accountability Offices Lack A Key Tool To Understand Unintended Impacts Of Crisis Response

The hydroelectric project in Mexico described above was billed as an impact

investment. Thanks to IFI co-financing, an accountability office was available.

Unfortunately, many institutions financing responses to COVID-19 do not have corresponding independent accountability offices or similar venues that enable them to hear directly from impacted communities. This is a particular challenge for impact investors, whose activities seek positive social and environmental outcomes alongside financial returns. The COVID-19 crisis has sparked the impact investing world to address the immediate and long-term needs created by the pandemic. From investing in healthcare infrastructure to addressing the overall economic and development crisis, impact investors are ramping up efforts to ensure a sustainable recovery. However, without accountability offices, impact investors lack a key tool to hear from the people affected by their investments who know whether investments are meeting their mark and if there are unintended consequences.

Without information about potential harm, impact investors are missing a vital piece to understand the net impact of their investments. Even among private impact investors already committed to strong environmental and social standards, none have independent accountability offices where communities harmed by their investments can be heard. This gap threatens to undermine the effectiveness of impact investors’ crucial work during this time.

So how can impact investors gain access to the community feedback that has proved such a vital source of learning and problem-solving for IFIs and the communities they affect? The moment is ripe for the creation of a community feedback system as a resource for the impact investing field, modeled on the independent accountability offices of IFIs. This system could take the form of a collective accountability office with a small staff, possibly housed within an existing investor network, that receives community grievances and facilitates a reliable response. This approach of creating a shared mechanism, rather than bespoke accountability offices for each investor, would greatly reduce individual costs while providing immense benefit to the impact investing field.

The Case for Independent Accountability Offices

As existing independent accountability offices show their worth, it begs the question: how can financiers without accountability offices, including impact investors, be confident their investments are best responding to this crisis? With over two decades of learning from IFIs’ accountability offices, the importance of community feedback to fully understand project outcomes and improve net impact is indisputable. As COVID-19 increases vulnerabilities and heightens the risks if projects go wrong, now is the time for the impact investing field to act on this learning and create the tools needed to ensure their efforts build, rather than undermine, the resilience of our global community.